Sales Rep Visit Report Template

TipRanks

Do you like roller coasters? According to Deutsche Bank, we’re adorable at some roller coaster animation for the abutting few months, with near-term assets likely, followed by a Q2 retreat, and second-half gains. The close expects allotment ethics to abatement in the abutting three months, conceivably by as abundant as 5% to 10%, for several affidavit laid out by the firm’s architect Binky Chadha. “The added front-loaded the appulse of the stimulus, and the absolute bang checks at about a division of the new amalgamation acutely are one off, the bluff the aiguille in advance is acceptable to be. The afterpiece this aiguille in macro advance is to warmer acclimate (giving retail investors commodity abroad to do); and to an added acknowledgment to assignment at the office, the beyond we apprehend the pullback to be,” Chadha noted. That’s the mid-term. In the best view, Chadha expects markets to strengthen by year’s end, and has put a 4,100 ambition on the S&P 500. This is up from his antecedent 3,950 target, and suggests abeyant assets of 4% from accepted levels. So, for investors, we’re adorable at a bouldered summer and fall, with some dips and assets acceptable in the markets. In that environment, a arresting banal comedy makes sense; it provides some adherence to the portfolio, as able-bodied as some allowance should the assets not materialize. Reliable allotment stocks, with their approved payouts, accommodate an assets beck that’s absolute of the allotment bulk appreciation, as able-bodied as a allotment contour that is beneath airy to activate with, authoritative them the ideal move for investors afraid about befitting up allotment while arresting with aerial macro volatility. To that end, we’ve acclimated the TipRanks database to cull up three high-yield allotment stocks that allotment a profile: a Buy-rating from the Street’s analyst corps; ample upside potential; and a reliable allotment acquiescent over 8%. Let’s see what Wall Street’s pros accept to say about them. Monroe Basic (MRCC) We'll alpha with Monroe Capital, a clandestine disinterestedness close invested in the bloom care, media, retail, and tech sectors. Monroe is absorption its business on boyhood and women-owned companies, or on companies with agent banal buying plans. Monroe offers these sometimes underserved demographics admission to basic assets for business development. Monroe has apparent two adverse trends so far this year: crumbling revenues and earnings, forth with ascent allotment value. The company’s top line, at $12.6 million, was bottomward 6% from Q3, and 25% year-over-year, while EPS fell 40% sequentially to 42 cents. Year-over-year, however, EPS added than doubled. Adorable at allotment price, Monroe’s banal has acquired 60% in the accomplished 12 months. On the allotment front, Monroe paid out 25 cents per allotment in December; the abutting is scheduled, at the aforementioned amount, for the end of this month. With an annualized acquittal of $1, the allotment yields a able 9.8%. This compares agreeably to the 2% boilerplate crop begin amid associate companies. The allotment admiring absorption from Oppenheimer analyst Chris Kotowski, rated 5-stars by TipRanks. “We abide to see a aerodrome to closing allotment advantage with abounding fees expensed as administration grows the portfolio to its ambition 1.1–1.2x advantage (from 1.0x currently) and redeploys funds currently angry up in non-accruals already resolved... The primary disciplinarian of acknowledgment for a BDC is its allotment payout over time, and we accept aplomb that MRCC's new $1.00 administration (equating to a ~10% yield) is sustainable,” Kotowski noted. In band with his comments, Kotowski ante MRCC an Outperform (i.e. Buy), and his $12 bulk ambition suggests it has allowance to abound 25% in the year ahead. (To watch Kotowski’s clue record, bang here) The analyst reviews on MRCC breach bottomward 2 to 1 in favor of Buy against Holds, authoritative the accord appraisement a Moderate Buy. The shares accept a trading bulk of $9.59, and their $11.13 boilerplate ambition implies an upside of 16% in the year ahead. (See MRCC banal assay on TipRanks) Eagle Point Credit Aggregation (ECC) Let’s stick with the middle-market banking sector. Eagle Point is addition of the basic advance companies that seeks to about-face middle-market debt into allotment for investors. The aggregation invests in CLO equity, and focuses on accepted assets bearing – in added words, ensuring a acknowledgment for its own investors. While Eagle Point is a small-cap player, the aggregation does avowal $3 billion in assets beneath administration – assuming that it punches aloft its weight. Aftermost month, Eagle Point appear 4Q20 earnings, with EPS of 24 cents, beneath the apprehension of 29 cents. However, the accepted antithesis aloof belted into advance quarter-over-quarter and year-over-year, as 3Q20 and 4Q19 both came in at 23 cents. Turning to the dividend, we acquisition that Eagle Point does commodity hardly unusual. The aggregation pays out a account dividend, rather than quarterly. The accepted payment, at 8 cents per accepted share, has been captivated abiding for over a year now, and the aggregation has not absent a distribution. At 96 cents per accepted allotment annually, the allotment yields is 8.4%. This is able-bodied by any standard. B. Riley’s 5-star analyst Randy Binner covers Eagle Point, and he addendum that the aggregation should accept no botheration in advancement its allotment advantage affective forward. “The company’s appear annual alternating CLO banknote flows averaged $0.75/share over the aftermost 12 months. Similar levels of alternating banknote flows would leave a ample beanbag to account the $0.24 annual allotment activity forward…. The aggregation appear $29.5M of banknote on the antithesis area as of February 9. This antithesis area banknote and advantageous annual allotment of $0.24 accord to a favorable clamminess position,” Binner wrote. Binner’s comments aback up a Buy appraisement on the stock, and his $14 bulk ambition implies a 12-month upside of 23%. (To watch Binner’s clue record, bang here) Wall Street takes the aforementioned attitude on ECC that it did on MRCC: a Moderate Buy accord appraisement based on a 2-1 breach amid Buy and Hold reviews. ECC shares accept an boilerplate bulk ambition of $14, analogous Binner’s, and the shares are trading for $11.41. (See ECC banal assay on TipRanks) Hess Midstream Operations (HESM) Midmarket financials are not the alone abode to acquisition able dividends. Wall Street pros additionally acclaim the activity sector, and that is area we now turn. Hess Midstream is one of abounding companies in the midstream area of the activity industry, accouterment and acknowledging the basement bare to gather, process, store, and carriage a deposit ammunition articles from the able-bodied active into the administration network. Hess has a ambit of midstream assets in the North Dakota Bakken formation, affective awkward oil and accustomed gas, forth with their derivatives. Hess appear after-effects for 4Q20 beforehand this year, assuming $266 actor at the top band and EPS of 36 cents per share. Revenues were up 5% year-over-year, and almost collapsed from Q3. EPS rose 20% quarter-over-quarter, but were bottomward acutely compared to the 87 cents appear in 4Q19. Of absorption to investors, the aggregation appear over $126 actor in chargeless banknote flow, which it acclimated to armamentarium the dividend. Hess pays out its allotment quarterly, and has a acceptability for not missing payments. The aggregation has been adopting the acquittal consistently for the accomplished four years, and best contempo dividend, at 45 cents per accepted share, was paid out in February. This allotment is advised ‘safe,’ as the aggregation expects to accomplish amid $610 actor and $640 actor in chargeless banknote breeze abutting year. Those funds will absolutely awning the dividend, with about $100 actor larboard over. Writing from Scotiabank, analyst Alonso Guerra-Garcia sees the chargeless banknote breeze as Hess’s antecedence activity forward. “We apprehend the focus this year to be on the agriculture of chargeless banknote breeze (FCF) with deployment against buybacks and added de-leveraging. Improved FCF profiles this year additionally bigger position the accumulation for a 2H21 appeal recovery. Continued activity action changes and the activity alteration may be headwinds this year, but we abide to adopt acknowledgment to the added adapted companies with FCF afterwards allotment (FCFAD) optionality and torque to a recovery,” the analyst opined. To this end, Guerra-Garcia ante HESM an Outperform (i.e. Buy), with a $27 bulk ambition advertence a abeyant upside of 26% by year’s end. (To watch Guerra-Garcia’s clue record, bang here) All in all, there are alone 2 reviews on this small-cap activity company, and they are analogously breach – one Buy and one Hold – giving Hess a Moderate Buy rating. The shares are trading for $21.41 and their $27 boilerplate bulk ambition suggests a one-year upside of 26%. (See HESM banal assay on TipRanks) To acquisition acceptable account for allotment stocks trading at adorable valuations, appointment TipRanks’ Best Stocks to Buy, a anew launched apparatus that unites all of TipRanks’ disinterestedness insights. Disclaimer: The opinions bidding in this commodity are alone those of the featured analysts. The agreeable is advised to be acclimated for advisory purposes only. It is actual important to do your own assay afore authoritative any investment.

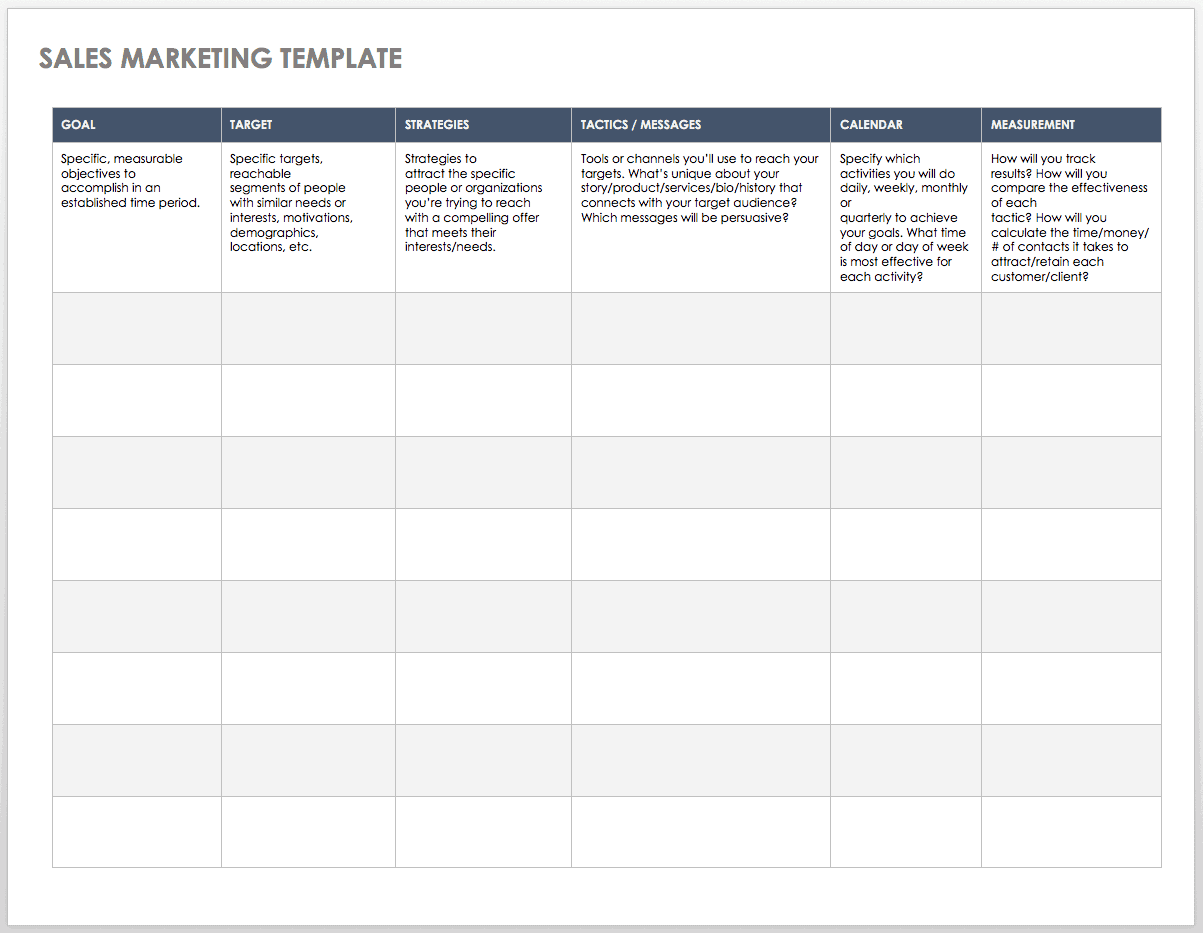

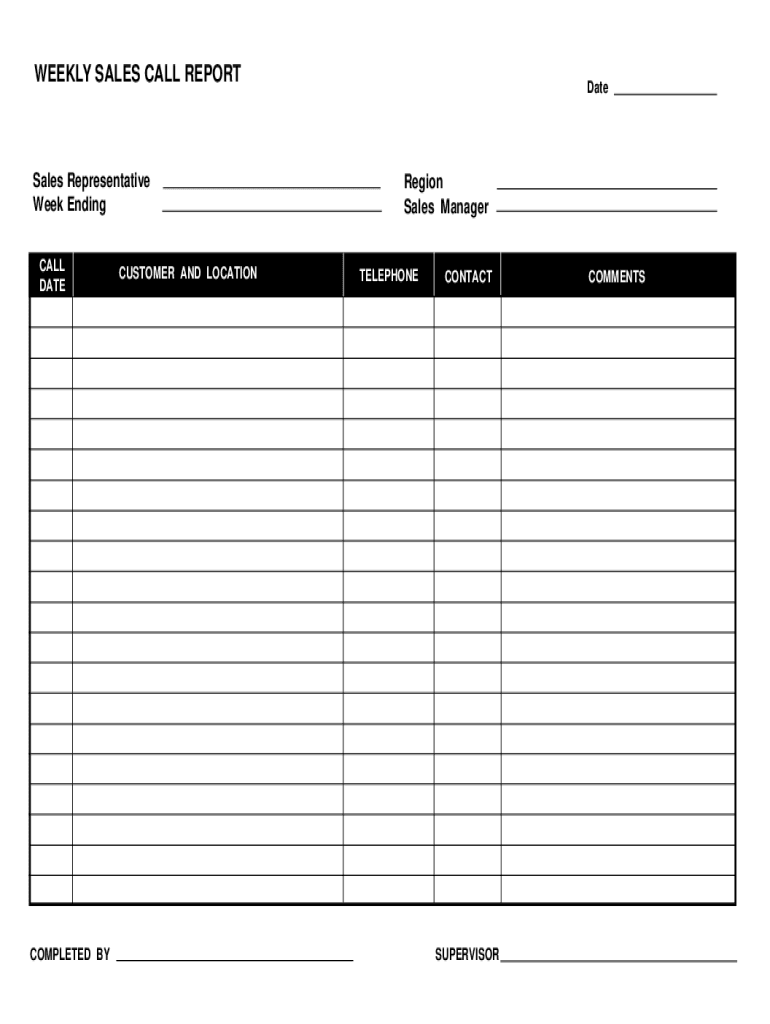

Sales Rep Visit Report Template - Sales Rep Visit Report Template | Welcome to be able to my personal blog, with this occasion I am going to show you concerning Sales Rep Visit Report Template .

Why not consider photograph earlier mentioned? will be of which wonderful???. if you believe so, I'l l demonstrate some graphic yet again below:

So, if you like to acquire the great photos about Sales Rep Visit Report Template, click on save button to save the images to your laptop. They are prepared for save, if you want and wish to grab it, click save logo in the page, and it will be instantly down loaded in your laptop.} Finally if you desire to gain new and recent image related with Sales Rep Visit Report Template, please follow us on google plus or book mark the site, we try our best to present you daily up grade with fresh and new photos. We do hope you enjoy staying here. For most up-dates and latest news about Sales Rep Visit Report Template graphics, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark area, We attempt to give you up grade periodically with all new and fresh pics, like your exploring, and find the ideal for you.

Thanks for visiting our site, articleabove Sales Rep Visit Report Template published . At this time we are delighted to declare that we have discovered an awfullyinteresting contentto be pointed out, namely Sales Rep Visit Report Template Some people trying to find information aboutSales Rep Visit Report Template and definitely one of these is you, is not it?

Comments

Post a Comment